AC Milan’s new owners bet they can top a miracle season

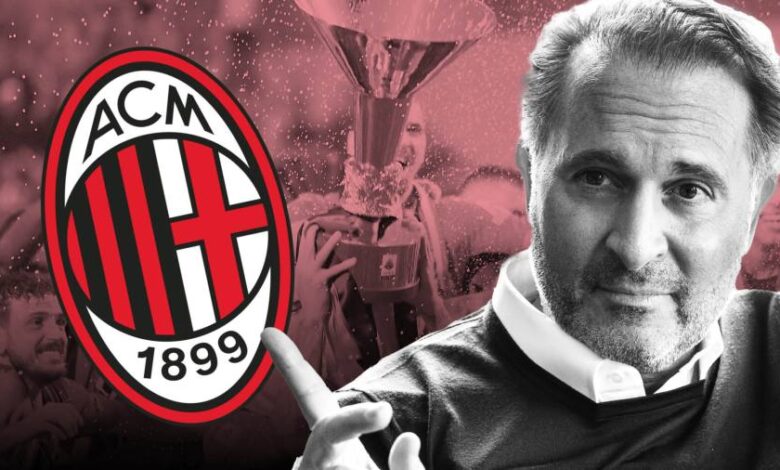

Hours after landing in Milan on a late May day, Gerry Cardinale bypassed the press crowd camping outside her hotel and arrived at the home of an Italian football legend.

Cardinale, founder of US investment group Red birdjust signed a 1.2 billion euro deal to buy AC Milan from hedge fund Elliott Management, but before it is announced to the public and the city’s passionate media on June 1, the 54-year-old wants to land Paolo Maldini.

“It was very important to me that I did it,” Cardinale said of his lunch with Maldini, one of AC Milan’s most respected captains and now the club’s technical director. ministry, who recently accused Elliott of cutting him out of the sale talks. “We ended up spending three and a half hours together. . . It’s amazing.”

Surrounded by lemon trees and on a spread of prosciutto crudo and buffalo mozzarella washed by Aperol spritz, Cardinale reassured Maldini that he remained at the heart of the future of a club that just a few days earlier, the First Italian champion since 2011.

Spanning four weeks of negotiations for Cardinale, the meeting was also a gentle introduction to the often fraught politics of Italian football – one of the challenges RedBird must now navigate to make its ownership. I’m successful.

While New York-based RedBird has long harbored ambitions of owning an elite club, Elliott has so far shown little interest in selling the club it took control of last year. 2018.

Famous for a combative approach that has seen it lock horns for more than a decade with the Argentine government and openly encourage companies from Twitter to Samsung, Elliott a person familiar with the matter has become more receptive to the possibility of a sale this year.

Elliott’s founder, Paul Singer, is uncomfortable owning such a well-known business, the person added, annoyed by any offer of AC Milan simply as a title asset and very much annoyed to see the staff in the stands at the club’s San Siro stadium.

As the Serie A season nears its climax with AC Milan closing the title, the race to find a new owner is in full swing. Exclusive negotiations with Investcorp, the wealth management company led by Bahrain, collapse in May.

Cardinale wasted little time, flying to London on May 5 to meet Gordon Singer, who ran Elliott’s European operations and the founder’s son. When RedBird set out how it would improve AC Milan’s cash flow, their original plan to buy the club through a private equity deal turned into a more unconventional option that Elliott was financing. main.

Elliott has agreed to lend RedBird 600 million euros at 7% interest, an amount expected to drop to 200 million euros by the end of the year as the company raises money from existing investors and partners. The fund also warrants warrants, financial instruments that Elliott can convert into shares of 1 to 2% if the club is resold or goes public, according to people with direct knowledge of the matter. .

Cardinale, who founded RedBird in 2014, explains: “This allows us to make a dime, complete a deal, allowing them to stay engaged the way they want to participate,” Cardinale, who founded RedBird in 2014, explains.

However, the purchase process has drawn criticism from AC Milan board member Salvatore Cerchione, whose holding company Blue Skye owns just under 5% of the club.

“Blue Skye was unhappy about the opacity of the process,” Cerchione said in a statement to the Financial Times. “We are confused about the real motives behind getting rid of the club, especially with a bright future ahead of us.”

Elliott declined to comment on Cerchione’s criticism.

These financial silver linings built when Elliott left AC Milan add brilliance to the profits it generates from a club it was never meant to own.

Even after injecting 750 million euros into the club, Elliott will reap a profit of around 450 million euros – excluding interest payments coming from RedBird, according to people with direct knowledge of the matter. this topic. These people add that the return is about 15% per year.

Ownership of Elliott

Unlike RedBird, Elliott has no aspirations of owning a football club. As a team constantly working on finding money-making opportunities, Elliott discovered one in 2017 when little-known Chinese businessman Li Yonghong launched a bold bid to acquire AC Milan. from former Italian prime minister Silvio Berlusconi.

Led by Franck Tuil, then the fund’s senior portfolio manager, Elliott provided Li with 300 million euros in high-interest debt, secured his own source of income and gave him control of the Chinese businessman. Country of one of football’s most highly rated clubs. Li’s ownership is briefly demonstrated, with Elliott taking control when Li defaults.

“We started as financiers,” said Giorgio Furlani, portfolio manager at Elliott and board member at AC Milan. Financial Times Football Business Summit March. “Soon, within a year, the club was in financial trouble; the owner has been exploited in terms of resources. So we had to step in, we took over ownership.”

Elliott takes over a club in disarray – an inheritance complicated by the skepticism that welcomed the hedge fund establishment as owner.

As consecutive champions of Europe’s premier league in the 1990s and 2000s, AC Milan have not won Uefa’s lucrative Champions League since 2014. The exile weighs heavily on its revenues. , which is flat at around 200 million euros and leaving the San Siro, where it shares arch-rivals Inter Milan, is in urgent need of modernization.

Furlani recalls: “What we found when we took over was a completely dire situation: the club went bankrupt from a cash flow perspective, too little income, too many expenses.

At first, efforts to rotate the club yielded little results. In 2018, Ivan Gazidis, an acquaintance of Gordon Singer, was parachuted from Arsenal as chief executive with the task of fixing the club’s finances and building new revenue streams. Maldini was instructed to cut the team’s budget by eliminating big earners and bringing in younger, cheaper players.

A Uefa ban in 2019 from European competitions for historic violations of financial fair play rules only added to the gloom. It proved a fertile backdrop for tensions, as Gazidis clashed with Maldini and Zvonimir Boban, then the director of football, over whether to recruit expensive players. *

But the late 2019 signing of Zlatan Ibrahimović, one of the finest centre-backs of his generation, was a controversial exception and one that was decisive in sparking his fortunes. clubs on and off the field.

The now 40-year-old has helped the club return to the Champions League at the end of the 2020/21 season, a much-needed boost to their finances. It also returns to Deloitte’s Money Football League, a widely watched ranking of clubs by revenue, after earning 216 million euros that season.

Although Ibrahimović’s contribution has kicked off a recovery that has been sustained even amid the coronavirus pandemic, it is a youthful squad – consisting of Rafael Leão, Theo Hernández and Sandro Tonali – that has helped the club to become one of the biggest players in the world. the pinnacle of Italian football in the final season in which Elliott took control. .

Tu fa l’Americano

Despite this win, Cardinale described AC Milan as a “sleeping giant”. Closing the gap with well-funded competitors across Europe is a significant challenge.

The Wall Street veteran is betting that experience working with some of America’s top sports clubs, including the New York Yankees and Dallas Cowboys of American football, and athletes like Alex Rodriguez and basketball player LeBron James, created a playbook. that could take AC Milan to the next level.

A new stadium tops a to-do list for RedBird, which includes the introduction of a media rights package for all Serie A leagues as well as enlisting celebrities and fashion labels to bring some charm into the AC Milan brand.

“A brand of this size, like AC Milan, should have the infrastructure that showcases footballing power and global potential,” Cardinale said. “We already have a lot of experience with stadium projects in the US. Milan and Italy deserve to be a world-class stadium, home to the best sports and entertainment on a global scale. ”

Cardinale appears undeterred by the wealth accumulated from the Premier League, which has capitalized on its global appeal through a series of lucrative media deals. According to Deloitte, Britain’s top 20 clubs generated 5.1 billion euros in revenue in the 2019-20 season, 3 billion euros more than Serie A. Just a decade ago, that gap was about 1 billion euros. billion euros.

“There is a huge opportunity on a macro scale with Serie A,” Cardinale argues. “There shouldn’t be a revenue disparity of this kind in terms of media between Serie A and the Premier League.”

Leveraging Milan’s status as a global fashion capital – Armani, Versace and Prada are among the brands that call the city home – is also part of RedBird’s multi-pronged strategy to build AC Milan as a business.

The stakes are very high for RedBird. Although its investments span YES, the regional sports network of the Yankees and Fenway Sports Group, owner of Liverpool FC and the Boston Red Sox, AC Milan is by far the most high-profile acquisition.

The recent record of other wealthy Americans seduced by both the rich heritage and future potential of Italian football is not encouraging. Boston-based hedge fund magnate James Pallotta’s plans to build a 52,500-seat stadium for AS Roma were thwarted by politics in 2014 and he’s sold the club ever since.

RedBird’s hopes of building a new stadium – along with their other ambitions – ultimately depend on AC Milan sustaining a renaissance on the pitch.

Cardinale’s introduction to Maldini was made by Maverick Carter, the owner of SpringHill Company, a media and entertainment business. consider RedBird as a shareholder.

“I connected him with Paolo because I knew how important and valuable that partnership was. [would be],” Carter said. The renewal of Maldini’s contract, which expires at the end of the month, was Cardinale’s top issue.

*This article has been revised to clarify Zvonimir Boban’s role at AC Milan