Adani crisis ignites India contagion fears, credit warnings | Business and Economy News

Fears of financial contagion spread in India on Friday as Adani Group’s crisis worsened, with credit rating agency Moody’s warning the group could face difficulties in raising capital, and S&P cut its outlook on two of its businesses.

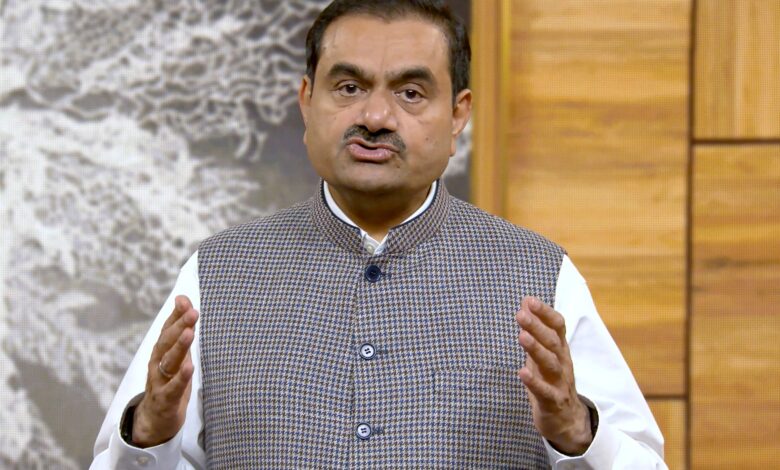

The chaotic scene in both houses of India’s parliament led to the postponement of the meeting on Friday as some lawmakers demanded an investigation following a severe crisis in the stock market values of Indian companies. Indian billionaire Gautam Adani.

The crisis was sparked by a Hindenburg Research Report last week, in which the US-based short seller accused the Adani Group of stock manipulation and unsustainable debt.

Adani Group, one of India’s leading conglomerates, dismissed the criticism and denied wrongdoing in detailed rebuttals but that didn’t stop the stock’s unabated decline. .

In the latest sign that the crisis is spreading, India’s Ministry of Companies has begun a preliminary review of the financial statements of the Adani Group and other regulatory submissions made over the years, two government officials told Reuters news agency.

Although shares of Adani companies have recovered from a sharp drop earlier on Friday, the seven listed companies are still lost more than 100 billion USD – about half their market value – since Hindenburg published the report on January 24.

Moody’s warned that the stock plunge could affect Adani Group’s ability to raise capital, although credit rating agency Fitch did not see an immediate effect on its rating.

“These adverse developments are likely to reduce the Group’s ability to raise capital to finance committed investments or refinance debt maturing in the next 1-2 years. We recognize that part of the capital investment may be deferred,” Moody’s said in a statement.

For Adani, a former school dropout from Gujarat, Indian Prime Minister Narendra Modi’s western home state, the crisis is the biggest business and reputation challenge of his life as his company struggles mixed to assuage investor concerns.

Amid fears the turmoil could spill over into the broader financial system, some Indian politicians have called for a broader investigation and sources told Reuters the central bank had Ask lenders to provide details about exposure to this group.

“Contagion concerns are growing, but are still limited to the banking sector,” said Charu Chanana, market strategist at Saxo Markets in Singapore.

The Reserve Bank of India says the country’s banking system remains resilient and stable. State Bank of India said it was not concerned about exposure to Adani Group but further funding of its projects would be “assessed on its own merits”.

Shares of Adani Enterprises closed 1.4% higher after falling 35% earlier to its lowest level since March 2021. That low brings its losses to nearly $33.6 billion since the week. before, 70% off.

Shares of Adani Total Gas, a joint venture with France’s TotalEnergies, fell 5%, saying exposure to Adani’s companies was limited.

Adani Ports and Special Economic Zone rose 8%, while Adani Transmission and Adani Green Energy both fell 10%.

“There is a risk that investor concerns about corporate governance and disclosure are greater than what we currently factor into our ratings,” S&P said, cutting its outlook for the company. Adani Ports and Adani Electrical from stable to negative.

India’s divestment secretary Tuhin Kanta Pandey told Reuters that Life Insurance Corp (LIC) shareholders and customers should not worry about exposure to Adani Group.

The state-run LIC has a 4.23% stake in flagship Adani Enterprises, while its other investments include a 9.14% stake in Adani Ports.

‘One case’

Adani, 60, has in recent years forged partnerships and attracted investment from foreign giants as he pursues global expansion in industries from ports to electricity.

The financial and market turmoil means that foreign investors, many of whom have underestimated India when they think the country’s stock market is overvalued, are reducing their exposure. touch.

India’s Finance Minister, Nirmala Sitharaman, told Network18 when asked about market weakness: “An example, however it might be talked about a lot globally… would not be indicative of a weakness in the market. How well regulated the Indian financial markets are.”

The Hindenburg report said Adani’s main listed companies had “substantial debt” and shares of the seven listed companies fell 85% due to what they called sky-high valuations.

The Adani Group called the report baseless and said over the past decade its companies had “constantly reduced leverage”.

Listed Adani companies now have a total market value of $107.5 billion, compared with $218 billion prior to the report.

That forced Adani to cede the title of Asia’s richest person to Indian rival Mukesh Ambani of Reliance Industries Ltd, while Adani dropped to 17th on Forbes’ list of the world’s richest people.

He placed third, behind Elon Musk and Bernard Arnault.