Point closes at $115 million to give homeowners a way to monetize their home equity TechCrunch

Historically, landlords could only exploit the equity of their home by taking out a home loan or refinancing. But a new category of startups has emerged in recent years to give homeowners more options to invest in their homes in exchange for a slice of their home’s future value. their.

One of such startups, based on Palo Alto Just, announced today that it has raised $115 million in Series C funding after a year of rapid growth. The company declined to disclose its valuation.

Interestingly, the startup was founded by a trio including Alex Rampell, who is today general partner of Andreessen Horowitz (a16z) and also co-founder buy now, pay later for giant Affirm. He collaborated with Eddie Lim and Eoin Matthews started Point in 2015 before joining a16z. Rampell sits on the company’s board of directors, but is not involved in the day-to-day operations of the company.

So, what exactly does Point do? In an interview with TechCrunch, CEO Lim describes the startup as a marketplace that co-opts landlords with institutional investors. The company’s flagship product, Home Equity Investment, is designed to allow homeowners to receive cash in exchange for a certain percentage of their home’s future appreciation. Point said that last year, it received more than $1 billion in new capital commitments from real estate and mortgage-backed securities (MBS) investors.

How it works is that Point first assesses the applicant’s finances and makes a provisional offer. Then assign a home value – usually a home appraisal – and update the final offer. Once all closing conditions are met, Point says it will fund the investment within four business days. On average, the size of the Home Equity Investment (HEI) that Point makes is 15-20% of the home’s asset value.

Its average investment is around $100,000. And the average value of homes on its market is around $700,000, according to Lim. Investors typically invest about 15-20% of the value of a home. So if a house is worth about $1 million, they’d put in $150,000 or $200,000.

Homeowners use cash to do a variety of things, for example, carrying out home renovations, starting a small business, financing their children’s education, or saving for retirement, says Lim.

“We have $250,000 homes on our market as well as multimillion dollar homes and everything in between,” Lim said. “That can be a very lucrative way to earn cash.”

“The landlord has no obligation to pay us back for 30 years,” Lim told TechCrunch. “Of course, most people have some sort of event or sell their home, or refinance 30 years in advance.”

Image credits: Just(Opens in a new window)

Managing director likened the process to a venture capitalist backing a startup.

“It looks like [an investor] Lim said. “We invest in your home, and share its appreciation and advantages for the future.”

Since its founding, Point has invested in more than 5,000 homes. Although Point has been in business for several years, Lim said it has seen growth “most of it” in the past year, according to Lim. Specifically, he said, Point’s funding volume increased more than fivefold in the first quarter of 2022 compared to the first quarter of 2021.

“We“Where home equity has never been so abundant and inaccessible,” Lim told TechCrunch.

Indeed, one recent report pointed out that “Americans are using $26 trillion in home equity.”

The company believes the advantage to homeowners using Point, as opposed to taking out a home loan or refinancing, is that they “need no monthly payments, no income required, and no perfect credit.” “.

Lim describes Point as a “lightweight asset technology for home ownership.”

“We do not own any properties and rather connect homeowners with investors,” he explains. “As a marketplace, we charge both sides of the transaction. And we also charge property management fees with investors.”

Currently, the company operates in 16 states, including California, New York, Florida, Massachusetts, New Jersey, Washington, Colorado, Pennsylvania, Illinois, Maryland, Michigan, North Carolina, Arizona, Minnesota, Oregon and Virginia, as well as like Washington, DC It plans to enter 11 more states later this year, including Ohio and Nevada.

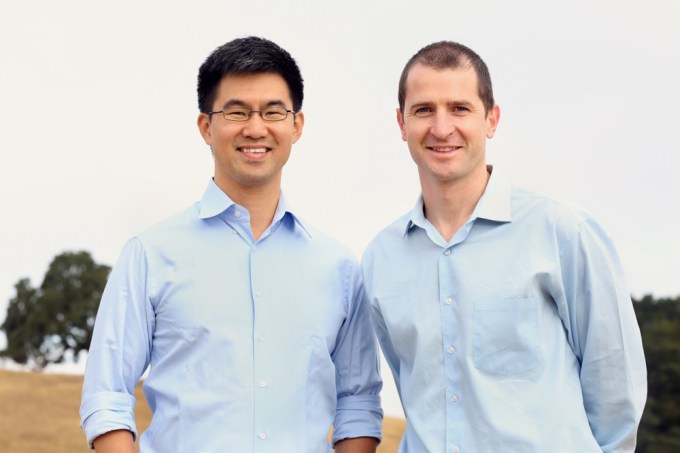

Image credits: Co-Founders Eddie Lim and Eoin Matthews / Point

The rise in mortgage rates has had a negative impact on digital mortgage startups as the number of refinances and new home purchases has decreased. But in this case, that could really act as a breath of fresh air for Point and the companies that like it, though Lim stressed that Point is not meant to replace refinancing, for example.

“People can still refinance and use Point,” he told TechCrunch.

Other players in this space include HomePace, which was raised last week $7 million Series A led by Lennar’s joint venture arm, LENX. Home page raised over $60 million in funding in December. Last October, Point announced $146 million worth of securitization. And in February, Unison completes $443 million worth of securitization.

WestCap leads Point’s Series C, which also includes participation from existing backers a16z, Ribbit Capital, REIT Redwood Trust, Atalaya Capital Management and DAG Ventures. New investors include Deer Park Road Management, The Palisades Group and Alpaca VC.

The investment brings the startup’s total equity to date to more than $170 million.

Point plans to use its new funds to scale its offering so it can “support more growth,” as well as work towards launching new products and expanding its presence across the country. . Naturally, it also wanted to hire more “instructors,” as Lim called the company’s employees. Currently, this startup has 210 employees.

“In Many, many ways, we’re just getting started,” Lim told TechCrunch, “in terms of how many homeowners are out there and how much equity is out there. We are finishedI want to bring this to every homeowner in the United States. ”

Laurence Tosifounder and managing partner of WestCap, was actually an angel investor in the company before leading this round through a growth holding company. He first supported the company in 2018.

“WestCap is leading this round at Point because they have developed the best and most consumer-friendly solution with the most flexibility and the least financial burden,” he told TechCrunch. “Point allows homeowners to securely manage their assets and invest in their future, even when unforeseen circumstances arise.”

Tosi — a former chief financial officer of both Airbnb and Blackstone — believes Point’s product stands out from its competitors in that it works with regulators, has the ability to securitize, and “has a securitization facility.” best investor” while “providing over-market investors, risk-adjusted returns. ”

For his part, Rampell – who leads the company’s seed pool and Series A rounds, and also invests in Series B – said in a statement that “the strength and depth of the team that Eddie Lim has trained on at Point and its innovative approach to financing homeowners was clear. ”

My weekly fintech newsletter, The Interchange, launches May 1! Registration this to get it in your inbox.