5 Stocks Foreign Institutional Investors Are Buying. This is why

Foreign investors increased their stake in IRB Infra to 34.9% in the October-December 2021 quarter.

After being repeatedly sold out by foreign institutional investors (FII) in October and November 2021, they are likely to return to the Indian market.

As of January 13, the FII had net bought $479 million worth of Indian securities, including $434 million worth of shares.

Before that, India was one of only two countries with net FPI flows for three consecutive months ending in December 2021.

Due to US Fed cuts and volatile global environment, FII has been forced to withdraw from emerging markets like India.

Why?

That is because high interest rates in the US have pushed the FII away and also because India has outperformed the major global market indexes.

Research analyst at Equitymaster, Aditya Vora, had this to say when we asked him about the state of FII in November.

The FII sale is clearly in pockets where valuations have risen beyond the baseline.

Additionally, large and mid-cap stocks that have high FII ratios and report lower-than-expected second-quarter results are under heavy punishment.

Typical are Jubilant FoodWorks, TCS, Divi’s Labs, Britannia Industries. Apparently the FII was sold with such names.

So what lies ahead? Are FIIs here to stay this time?

Let’s take a look at the top five Indian stocks in which FIIs have increased their holdings sequentially. Please note, the data is as of December 31, 2021.

We looked at stocks from the BSE 500 index.

#1 IRB Infrastructure Developer

Foreign investors increased their stake in IRB Infra significantly to 34.9% in the October-December 2021 quarter.

During the September quarter 2021, FII’s share in IRB Infra stood at 13.3%, increasing to 48.2% in Q12 2021. With this, IRB Infra has finally become a stock of choice for investors. Foreign investors bought in after three consecutive quarters of selling.

A large part of this has been acquired by Bricklayers Investment (GIC Investor). A month ago, the Competition Commission of India (CCI) approved the acquisition of up to 16.94% share capital of IRB Infra by Bricklayers Investment.

GIC Investor is a foreign investor, a 100% owned subsidiary of GIC Infra Holdings (GIC Infra), a 100% owned subsidiary of GIC (Ventures) Private Limited (GIC Ventures).

In addition to GIC, Cintra, an arm of Spanish infrastructure heavyweight Ferrovial, also invested in the company.

Both GIC and Cintra made this transaction among the largest equity crowdfunding by a listed infrastructure company, which will help IRB write off its balance sheet and gain access to funding. growth capital to participate in new projects and the government’s ambitious asset monetization scheme.

From the proceeds, IRB will use Rs 32.5 billion to repay corporate debt, Rs 15 billion as growth capital and Rs 6 billion for general corporate purposes.

Recently in an interview, the company’s president and MD VD Mhaiskar said they expect margins to continue to grow strongly in the future. He also said that toll collection has been showing good traction.

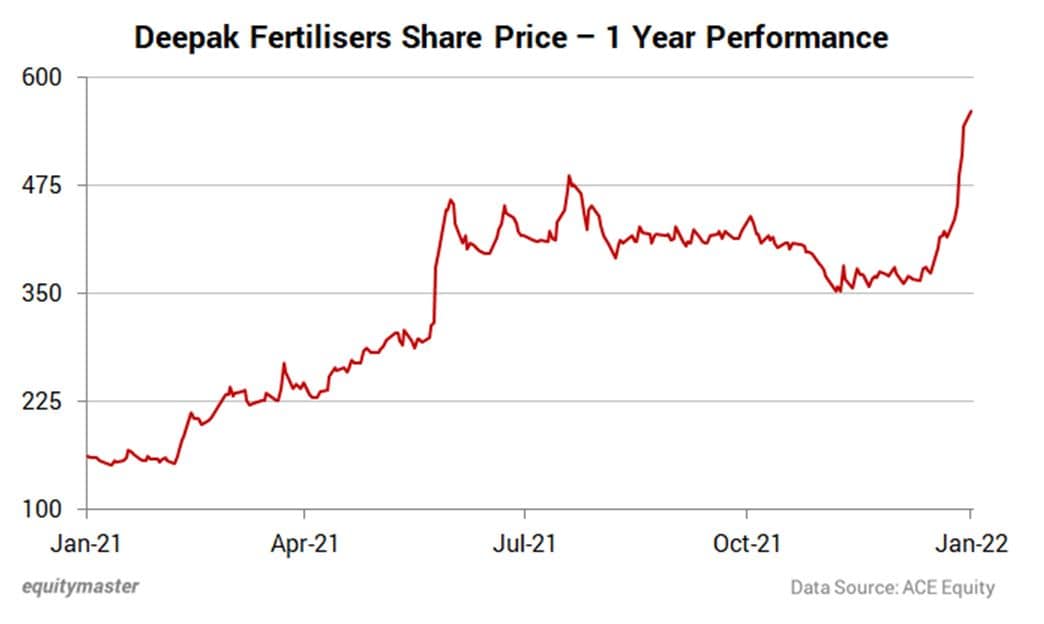

#2 Deepak Fertilizer

Even after gaining 250% in the past year, the FIIs still seem bullish on the commodity chemicals stock. FII injected a large sum of money into Deepak Fertilizers in the most recent quarter of December 2021.

As of September 2021, FII’s holdings in the company are at just 1.6%. Moving to December 2021, holdings are now 11.95%, up 10.4% in three months! It’s really big.

This is the reason of QIP that was launched by the company. During this quarter, Deepak Fertilizers raised Rs 5.1 billion through a qualified institutional stock offering (QIP).

The majority, about 82%, are registered by foreign investors.

This is the company’s first external equity financing since its initial public offering in 1982.

So why did the FII raise the stock price?

Well, the company is taking advantage of the growing mining demand by setting up a global scale engineering ammonium nitrate project.

The news comes a month before Smartchem Technologies, a wholly owned subsidiary of Deepak Fertilizers, said that Odisha Minister Naveen Patnaik had laid the groundwork for a 22-dollar engineering ammonium nitrate complex. billion Rs.

Deepak Fertilizers has been one of India’s leading manufacturers of fertilizers and industrial chemicals since 1979 when it was established as an ammonia producer. It has become a multi-product company.

FII must have also taken note of the company’s financial results for the September quarter of 2021 as the company reported a 16% increase in net profit, driven mainly by higher earnings.

In the past year, the company’s stock has increased by 250%.

All eyes will be on the company when it releases the results on January 28, 2022.

For more see Deepak Fertilizers’ latest equity model.

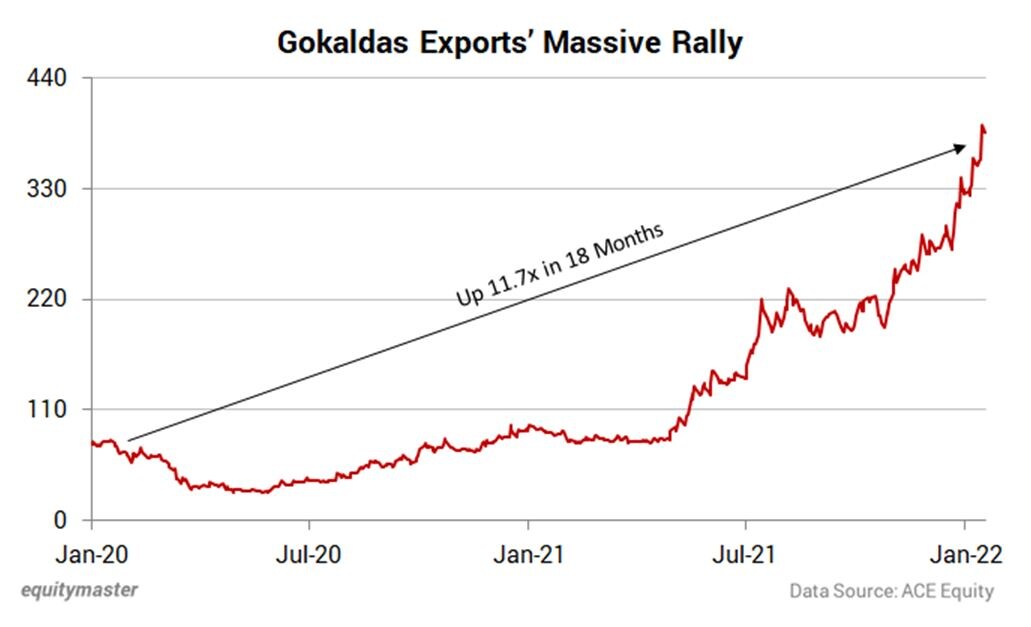

#3 Exporting Gokaldas

Bangalore-based Gokaldas Exports has seen their FII holdings increase from 4.6% in September 2021 to 12.4% in December 2021. This figure is based on QIP 3. billion Rs that the company issued in October 2021.

The clothing maker, backed by former Blackstone India head Mathew Cyriac, has successfully closed its share sale. Institutional investors such as SBI Mutual Fund, Goldman Sachs Asset Management, HSBC Asset Management and Tata Mutual Fund have registered its shares in the QIP.

A portion of the funds raised has been used to reduce debt levels, while the remainder will be used to meet working capital requirements and capacity expansion.

The company’s shares have surged recently after it was announced that Gokaldas plans to increase production capacity and also explore

new business opportunities.

Trading at Rs 30 in May 2020, shares of Gokaldas Exports have surged and are currently hovering near an all-time high.

This is because Gokaldas has strong financial reports and a strong order book. It also has an established market position and good relationships with major international customers.

In the first half (April-September) of the current fiscal year 2021-22, the company reported a 6-fold increase in profits.

In an interview, the company’s MD said Gokaldas will generate incremental revenue from the capacity expansion of Rs3.4 billion.

This is him the way he is,

Several factories are underway, which will bring growth to us for the next 3-5 years. The odd amount of Rs 340, which we will invest, will bring at least 4 times the turnover. So Rs 1,400 crore additional revenue will come from this investment.

It remains to be seen how good the company’s results are when it releases the numbers on January 21.

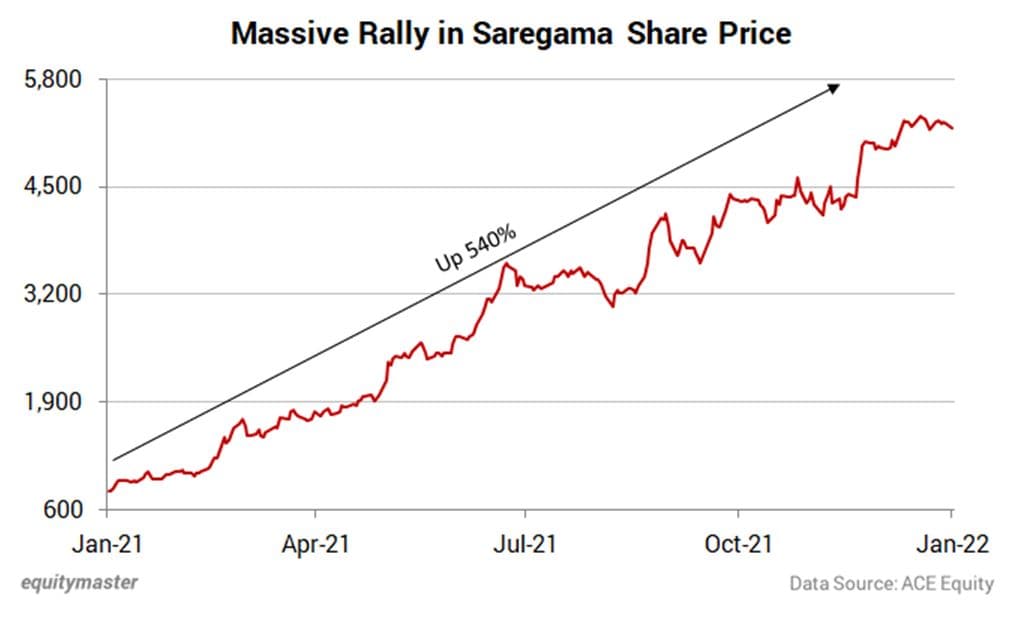

#4 Saregama

FII has been bullish on Saregama’s stock for quite some time. This is clearly shown when they have increased their share buying rate in the past 4 quarters.

FIIs only held a 4.4% stake in Saregama as of December 2020. Exposure is now a whopping 16.55%. Most of the increase happened in the most recent quarter.

Saregama is a company over 120 years old that started as a music label company in 1902. Today, the company’s portfolio includes the intellectual property rights to more than 4,000 hours of television content. produced for channels in languages like Hindi, Tamil, Telugu, Kannada, Malayalam and Bengali.

Over the past few decades, the company has forayed into music retailing through physical and digital media. It has the largest library of Indian music publishing and recording copyrights in 14 different languages.

With internet data prices low and smartphone usage increasing, Saregama wants to capitalize on the trend.

Saregama, formerly known as Gramophone Company of India, is a company under RP-Sanjiv Goenka Group. The group’s businesses include energy and energy, carbon

black manufacturing, retail, IT support services, FMCG, media and entertainment, and agriculture.

In the past year, the company’s stock has increased by 540%!

#5 Macrotech Developer

In mid-November 2021, Macrotech Developers raised Rs 40 billion from foreign and domestic institutional investors through the largest QIP ever by a property developer in India. .

This resulted in the company’s FII holdings increasing in the December quarter 2021 to 15.3%. In the previous quarter, FIIs held an 8.7% stake.

Capital Group, Ivanhoe Cambridge (a subsidiary of CDPQ), Wellington, Nomura, Manulife, Nippon and Max Life have increased their investments in the company through the QIP issue.

While these are existing shareholders, there are new names as well as GIC, Oppenheimer, the University Superannuation Scheme (USS) and Amundi.

As we see the boom in reality play out, foreign investors have turned bullish on big companies like Lodha, which are set to take market share away from smaller players.

Structural factors are also in place for significant growth in housing volume, especially in middle income and affordable segment. This is the focus area for Macrotech Developers.

In addition, sales are also good due to the government of Maharashtra stamp duty concession.

These reasons were more than enough to cause the anchor book to be oversubscribed more than 3 times and see traction from a diverse group of investors.

Interestingly, when the company conducted its IPO in April last year, the demand from domestic investors was very weak. But foreign institutional investors remained optimistic and bought the shares, which account for more than 87% of total institutional demand.

After a weak listing, the company’s shares are now up more than 170%.

After receiving support from foreign investors, Macrotech Developer is now on the way to achieving the dual goals of debt forgiveness and capital expansion through a joint development model.

In which other stocks did FII increase its weight?

In addition to the above, here are some stocks that FII increased its stake in in the most recent quarter of December 2021.

Since you are interested in tracking FII holdings, check out Equitymaster’s powerful stock screener.

This tool tracks what foreign investors are buying and selling.

Take a look at the screen below showing the key parameters of the above companies.

Meaningful of FII activities…

FII has long been in charge of the Indian equity market to some extent. Any sudden rise or fall from FII drives the stock up.

But this time it’s different. The year 2021 shows us how India’s dependence on FII has decreased. The participation of retail as well as domestic organizations is now very significant.

Even if FII remains bearish, India’s growth story will remain intact.

When FII was sold in November, domestic institutional investors were ready to support the market to some extent by buying.

However, since FII participation is already high and they have affected the Indian stock market to some extent, there can be volatility for stocks with high FII ratio.

That doesn’t mean you should steer clear of stocks that the FII holds can be huge. Just this factor needs to be considered.

Disclaimer: This article is for informational purposes only. It is not a stock recommendation and should not be treated as such.

(This article is provided from Equitymaster.com)

(This story has not been edited by NDTV staff and was automatically generated from the feed provided.)