Central Bank Myths Drag down World Economy — Global Issues

SYDNEY and KUALA LUMPUR, October 10 (IPS) – The dogmatic obsession with and focus on fighting inflation in rich countries is push the world economy into recession, with dire consequences, especially for poorer countries. This obsession is due to the myth shared by most central banks.

Inflation 1: Inflation chokes growth

The common story is that inflation affects growth. The major central banks (CBs), Bretton Woods institutions (BWI) and the Bank for International Settlements (BIS) have all asserted that inflation is bad for growth despite all the evidence to the contrary. The myth is based on a few very special cases.

“Inflation in the past in the US and Europe could slow global growth, with a potential global recession in 2023.” declare World Economic Forum The Chief Economist’s Outlook Under title“Inflation will inevitably lead to a recession.”

Atlantic recently warned, “Inflation is worsening… raising the prospect of a period of economic stagnation or even recession”. The Economist states, “It hurts investment and makes most people poorer”.

Without evidence, the narrative asserts causation runs from inflation to growth, with inevitable “adverse” consequences. But serious economists have not found convincing supporting evidence.

World Bank Chief Economists Michael Bruno and William Easterly request, “Is inflation bad for growth?” With data from 31 countries for the period 1961-94, they concluded, “The ratio of fervent belief to tangible evidence appears to be unusually high on this topic, despite extensive prior research. there”.

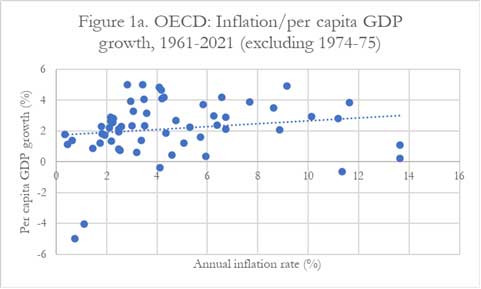

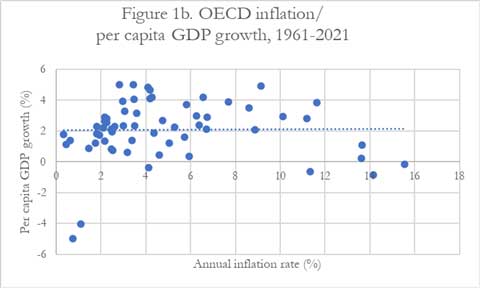

OECD Evidence for 1961-2021 – Figure 1a & 1b – updated Bruno & Easterly, again contradicting the ‘standard story’ of CBs, BWIs, BISs and others. The inflation-growth relationship is very positive when 1974-75 – the years of severe oil recession – are excluded.

The relationship did not become negative even when 1974-75 was included. Besides, “Great inflation“The years 1965-82 did not harm growth. Therefore, there is no empirical basis for setting a specific threshold, such as the current standard inflation target of 2% – which has long been acknowledged as “taken from the air“!

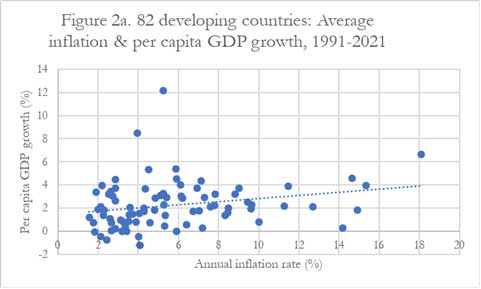

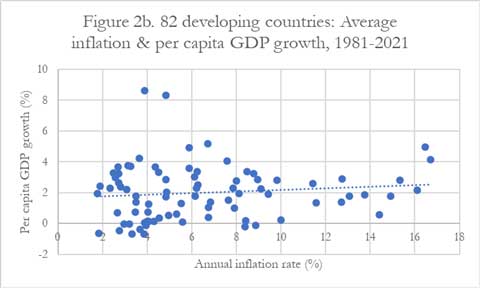

Developing countries also have a positive inflation-growth relationship if the circumstances are extreme – for example, the inflation rate exceeds 20%, or ‘exceed‘affected by commodity price fluctuations, civil strife, war – ignored (Figure 2a & 2b).

Figure 2a summarizes the evidence from 82 developing countries for the period 1991-2021. Although slightly weakened, the positive relationship was maintained, even when including the debt crisis years 1981-90 (Figure 2b).

Myth 2: Inflation always increases rapidly

Another common myth is that once inflation starts, it tends to increase rapidly. When inflation is thought to be on the rise, it is dangerous not to act decisively to tackle it in its infancy. So, the IMF’s chief economist advises, “Don’t let inflation ‘genie’‘out of the bottle’. Therefore, inflation must be “ strangled from the infancy ”.

But in reality, OECD inflation has never exceeded 16% in the past six decades, including the oil shock years of the 1970s. Inflation is not easily accelerated, even when labor is more likely to be employed. more bargaining power, or wages set at consumer prices – as in some countries.

Bruno & Easterly only see the possibility of rapid inflation when inflation exceeds 40%. Two MIT economists – Rüdiger Dornbusch and Stanley Fischer, later Deputy Executive Director of the International Monetary Fund – arrived same conclusiondescribes 15–30% inflation as “moderate”.

Dornbusch & Fischer also emphasizes, “Most moderate inflations are triggered by commodity price shocks and are short-lived; very few end up with higher inflation”. Crucially, they warn, “such inflationary episodes can only be alleviated at the … substantial cost of growth”.

Myth 3: Hyperinflation threatens

Although extremely rare, avoiding hyperinflation has become a reason for central banks to prioritize containing inflation. Hyperinflation – at a rate above 50% for at least a month – is certainly bad for growth. But according to IMF research Shows“Since 1947, hyperinflation in market economies has been rare.”

Many of the worst episodes of hyperinflation in history followed World War II and the collapse of the Soviet Union. Bruno & Easterly also deals with the breakdown of economic and political systems – as in Iran or Nicaragua, after the revolutions that overthrew corrupt autocracies.

One White House staff blog notes, “The post-World War II period of inflation may be a better comparison to the current economic situation than it was in the 1970s and suggests that inflation can quickly subside once supply chains completely online and the demand is pent-up”.

Myth 4: Evidence-based policy making

Central banks love to claim their policymaking is evidence-based. They cite each other and famous economists to enhance the aura of CB “credibility”.

Not surprisingly, the Reserve Bank of New Zealand has driven its discretionary 2% inflation target primarily by endless repetition – not strong proof or superior logic. They are simply “spend a great deal of effort“To preach a new spell”for all who will listen – and some who don’t“.

The story is also relevant to those concerned about wage pressures. Fighting inflation has created an excuse to further undermine the working conditions and wages of workers. So, The share of workers’ incomes has declined since the 1970s.

Greater central bank independence (from the regulator) has enhance the influence and power of financial interests – largely at the expense of the real economy. As a result, output and employment growth weakened, worsening many, especially in the Global South.

Fact: Central banks cause recessions

Inappropriate CB policies often slow down economic growth without mitigating inflation. The hawkish CB’s responses to inflation can turn out to be self-fulfilling prophecies with high inflation seemingly associated with recession or growth collapse.

Before becoming Fed chair, Ben Bernanke’s research team concluded, “An important part of the impact of an oil price shock on the economy is not due to changes in oil prices, but rather from tightening monetary policy.“.

As a result, central bank interventions caused contractions without reducing inflation. The longest US recession after the Great Depression – in the early 1980s – was attributed to Fed President Paul Volcker 1979-1981 raised interest rates.

A recent New York Times opinion editorial warned, “Powell’s pivot to tighter money in 2021 is comparable to Mr. Volcker’s 1981 moveand “the economy of the 2020s may look like the 1980s”.

Fear of an “extremely severe” world recession, Columbia University history professor Adam Tooze summed up the current CB rate hike frenzy as “the most impressive simultaneous monetary tightening ever”!

Obsessions, especially if based on unfounded beliefs, never provide a good basis for sound policy making.

IPS UN Office

By @IPSNewsUNBureau

Follow IPS News UN Office on Instagram

© Inter Press Service (2022) – All rights reservedOrigin: Inter Press Service