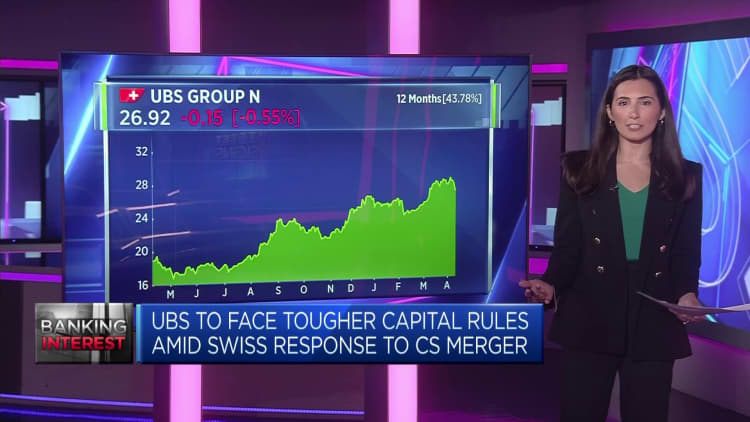

New Swiss bank laws could derail UBS’ challenge to Wall Street giants

Sergio Ermotti, CEO of Swiss banking giant UBS, during the group's annual shareholders meeting in Zurich on May 2, 2013.

Fabrice Coffini | Afp | beautiful images

of Switzerland New strict banking regulations create a “lose-lose situation” UBS and could limit its potential to challenge Wall Street giants, according to Beat Wittmann, a partner at Zurich-based Porta Advisors.

In a 209-page plan published on Wednesday, the Swiss government proposed 22 measures to tighten control of banks deemed “too big to fail”, a year after authorities forced must broker for these banks. UBS emergency rescue of Credit Suisse.

The government-backed takeover is the biggest merger of two systemically important banks since the Global Financial Crisis.

At $1.7 trillion, UBS's balance sheet is now twice the country's annual GDP, prompting increased scrutiny of safeguards around the Swiss banking sector and the wider economy. larger after the collapse of Credit Suisse.

Speaking to CNBC's “Squawk Box Europe” on Thursday, Wittmann said that Credit Suisse's collapse was “a completely self-inflicted and predictable failure of government, banking, and financial policy.” central banks, regulatory agencies and above all”. [of the] Minister of Finance.”

“Then of course Credit Suisse had a failing, unsustainable business model and poor leadership, all manifested by a falling share price and widespread credit spread. [20]22, [which was] is completely ignored because there is really no institutionalized know-how at the policy-making level to monitor the capital markets, which is needed in the case of the banking sector,” he added.

Wednesday's report is set to give more powers to the Swiss Financial Market Supervisory Authority, impose a capital surcharge and strengthen the financial position of subsidiaries – but does not propose a “total increase” set” of capital requirements.

Wittman said the report does not allay concerns about the ability of politicians and regulators to supervise banks while ensuring their global competitiveness, saying it ” creates a disadvantage for Switzerland as a financial center and makes it impossible for UBS to develop its banking system.” potential.”

He argues that regulatory reform should be prioritized over tightening regulations on the country's largest banks, if UBS wants to take advantage of its newfound scale and eventually challenge the likes of Goldman Sachs, JP Morgan, Citigroup And Morgan Stanley – has a similarly sized balance sheet but trades at a much higher valuation.

“It comes down to the regulatory level playing field,” Wittmann said. Of course it's about capacity, then it's about incentives and regulatory frameworks, and regulatory frameworks like capital requirements is an activity at the global level.”

“There is no way that Switzerland or any other jurisdiction is imposing very different rules and levels there – it doesn't make sense, then you can't really compete.”

For UBS to optimize its potential, Wittmann argued that the Swiss regulatory regime must be aligned with those in Frankfurt, London and New York, but said Wednesday's report showed “no will engage in any relevant reforms” would protect the Swiss economy and taxpayers, but allow UBS “to keep pace with global rivals and US valuations.”

“The track record of policymakers in Switzerland is that we had three banks that were involved in the global system and now we have only one left, and these cases are a direct result of lack of regulation and enforcement.”

“FINMA had all the legal background, the tools available to deal with the situation but they didn't apply it – that's the problem – and now we talk about fines, and that sounds stupid and stupid to me.”