Why is Tesla so hard to insure and so expensive?

We already own Tesla Model 3 as of November 2019. Every year when it comes time to renew our insurance policy, there is the unpleasant surprise of skyrocketing premiums or a complete refusal to insure the vehicle.

I was curious why it was so difficult to get insurance for a Tesla… so I contacted the Insurance Council of Australia to see why insurers were denying coverage or charging much higher fees. compared to a similarly priced vehicle.

Before we explain why, I want to explain the situation we were in with our Model 3. I am over 30 years old, so is my wife. We haven’t had any insurance claims before, we live just outside the Melbourne Central Business District and we’ve both had no licensing issues.

Our first policy in November 2019 was with UbiCar. It has a deal value of $96,800 (they also offer a new replacement for the old) and an annual premium of just over $1400. I thought it was a pretty reasonable price, so we closed it and were pretty happy.

At this point, the new Model 3 is available in Australia and UbiCar is one of the few insurers on the list. They also ask drivers to run an OBD monitor or phone app to monitor your driving performance.

For reference, around the same time I bought my Toyota Supra. It was about $10,000 more expensive to buy and I also insured it with UbiCar, but it was $1100 with a deal value of $104,000.

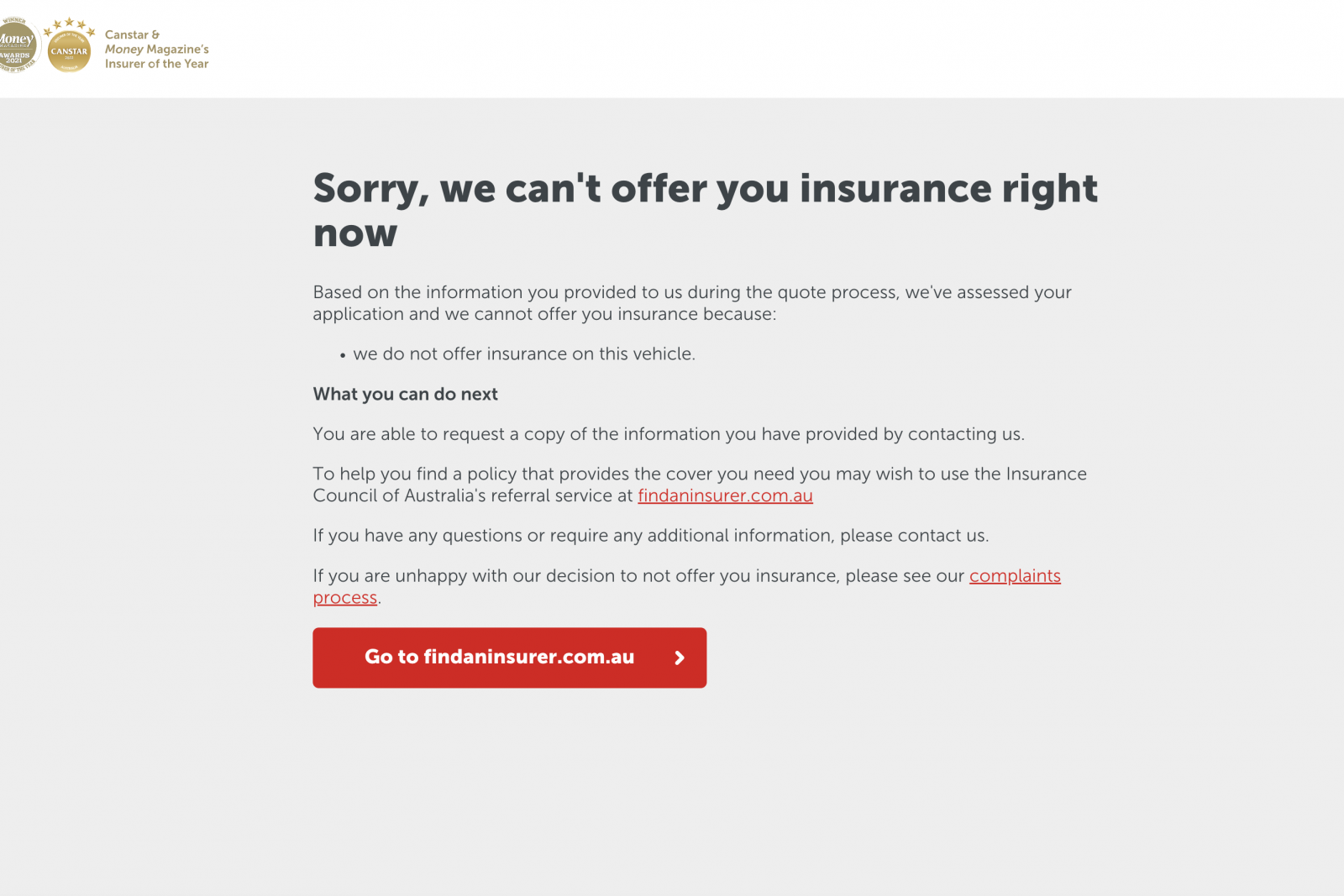

Next year is when things start to get expensive. UbiCar shut down and I started shopping around, and noticed some insurance companies refused to offer any coverage, not even an expensive policy. Allianz even offers a funny premium of $9000 for comprehensive coverage.

I ended up with AAMI, which is $1800 for the full with limited mileage, $1100 in excess, and a lower deal value of $80,000.

Next year is when things start to get a little crazy. In November 2021 when I received the renewal notice from AAMI it had increased to just over $2000 and the agreed value was reduced to $74,000.

So I kept looking for other quotes. I started pulling my hair when some of the biggest insurance companies refused to provide coverage for a Tesla. The list of insurance companies that refuse to cover Tesla includes:

- Direct Budget Insurance

- Woolworths Insurance

- Coles . Insurance

- Group chat

- Direct Budget

- Kogan Insurance

- Play lotto

- WIND

- DOLL

- MyStateBank

- CGU

Even if I did find an insurance company to eventually insure my car, the cost of the insurance would be about the same as a car worth 50% more than a Tesla, so it proportionally much higher than a similarly priced vehicle.

So what’s the story? I contacted the Insurance Council of Australia, and a spokesperson explained why Tesla and electric cars in general are so difficult to get insurance.

“There are a number of possible reasons for the cost of insurance,” they said.

“These may include:

- Computer technology and parts in electric vehicles are more expensive to manufacture and replace

- Repairing damaged electric vehicles requires importing parts into Australia

- There are very few service centers across Australia that can repair electric vehicles, which may require transporting the vehicle to a remote location for repair.

- Electric vehicle repair requires specialized technicians, and currently there are relatively few people with this training in Australia.

- Handling damaged electric vehicle batteries takes a lot of time and effort. It also requires special equipment and processing (recycling) methods. A key factor in cost is the risk associated with electric vehicle batteries and replacement requirements.

- The supply chain in Australia is in its infancy leading to higher costs, the situation is unlikely to improve until demand and then supply increase.

- All vehicle supply chains have been impacted by the pandemic, with increased costs in the repair sector, the spokesperson said.

While some of the first reasons make sense, the rest are likely to take longer (and more frustratingly) to get through.

Many established luxury brands in Australia have large stockpiles of spare parts and some even run their own repair centers, so insurers are less of a headache. .

Tesla, on the other hand, seems to move much of this to the aftermarket, which seems to result in claims taking forever and becoming too complicated for insurance companies to deal with.

For example, when our Model 3 was delivered, it had a paint defect. Tesla had to resort to a third-party panel shop to repair the panel instead of doing the job at home.

With Tesla now leads in electric car sales in Australia and sales are more likely to come as the Model Y goes on sale later this year, which is an issue that will only complicate as time goes on.

What is the solution? Tesla runs its own insurance company in the US to help reduce the cost of insurance based on their internal risk factors. That coverage is not available in Australia and there is no indication as to whether it will eventually become available.

Tesla no longer runs its company’s public relations department, so there’s no one to ask.

We asked Victoria’s peak auto regulator, the VACC, what they think of the insurance situation and VACC boss Geoff Gwilym claims the insurance board needs to do more.

“There is a significant labor shortage in the auto industry and it is only getting worse,” said Gwilym.

“If the Insurance Council of Australia wants more people to fix cars, what are they going to do about it? What are they doing to attract more people into the industry? What are they doing in terms of training? How about they use some of their substantial profits to incentivize people to enter the industry, instead of penalizing motorists with high insurance premiums. ”

“There are a lot of trained people ready and willing to repair electric vehicles, but some electric vehicle companies will not supply their parts to the aftermarket industry,” he said.

Either way, if you’re about to go out and buy a Tesla or any other electric car for that matter, make sure you can get insurance in advance, otherwise you could end up paying a nasty premium.