China’s strict Covid scupper hopes for a wealth revival

Li Huixiang, a real estate broker in the central Chinese city of Zhengzhou, was expecting a good March. In an effort to boost the city’s burgeoning real estate sector and the local economy with it, city officials unveiled a host of incentives, including lower mortgage rates and subsidies. cash grants to new home buyers.

But Li, usually a star agent in one of Zhengzhou’s biggest residential areas, has sold just five apartments in Sunac City since the measures were announced – a fraction of sales. his usual sales.

“Stimulus measures are not enough to offset the negative factors that are showing little sign of abating,” Li said, citing factors including Covid-19-related travel restrictions and household income. family decreased.

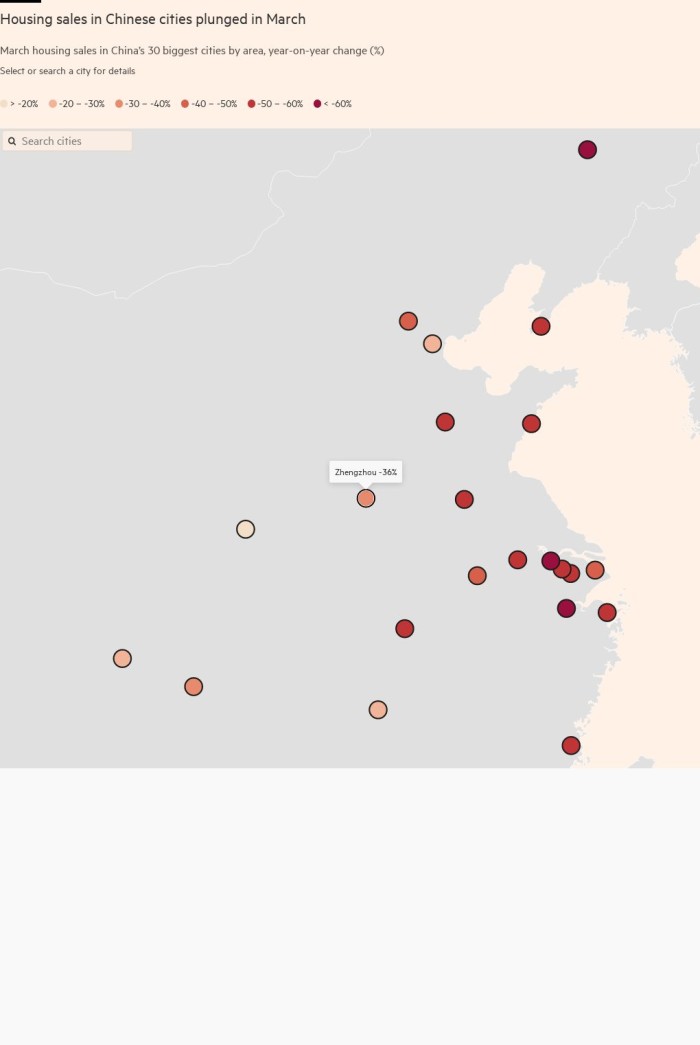

Year-on-year, new home sales in Zhengzhou fell more than 30% in the six weeks from March 1 to mid-April, reflecting a nationwide trend.

The city, the capital of Henan province and just 2.5 hours south of Beijing by high-speed rail, requires all arrivals to be quarantined for three days. Li and other brokers say the influx of property buyers from other provinces or cities, who used to make up more than half of their sales, has stopped.

“There is a contradiction between promoting housing sales and following Covid containment rules,” Li said.

There have also been disruptions in Zhengzhou, which is home to 12.6 million people and recently locked down a large area where the airport and major factories supply Apple.

Authorities also contacted people with cell phone records showing they visited the area before it was closed, asking them to quarantine for seven days.

Xi’s administration has made it clear that, despite the hardships of people in Shanghai and other lockdown-affected cities, containing Covid will remain its top priority. Shanghai’s closure was originally intended to be partial and to last no more than 10 days, but was extended indefinitely.

On Monday, the National Bureau of Statistics said housing starts fell 20% in the first quarter, compared with the same period last year, even though at least 60 other cities have implemented supportive measures. similar property support to Zhengzhou.

While NBS estimates that the first quarter economic output Expanding at a stronger-than-expected 4.8%, March data showed the beginnings of a significant recession as Shanghai and dozens of other cities began enforcing lockdowns to stem the outbreak. virus outbreak and highlight the controversy of President Xi Jinping Policy “zero-Covid”.

The most stringent shutdowns have been concentrated in the Yangtze River Delta around Shanghai, ramping up logistics in one of the country’s most important manufacturing and export areas, but Zhengzhou has also been affected. enjoy.

China’s central bank has had three opportunities to cut interest rates by different types since April 15, but chose to keep all three rates unchanged. Its only agreement to policy easing this month was a 25 basis point cut from expected in banks’ required reserve ratio.

A Beijing-based government policy adviser, who requested anonymity, said that even before Covid shutdowns began to spread in March, “top leadership underestimated the impact of the pandemic.” effect of the real estate crisis on the broader economy”.

“The situation,” he added, “could get worse before it gets better.”

Zhengzhou’s real estate stimulus package, one of the strongest in the nation, is said to be needed to rescue the sector from disaster in 2021. According to official data, new home sales in the city fell by a third last year while land sales, a major source of financial revenue, fell by a quarter.

In addition to Mr. Xi’s repression highly leveraged developersLast year, Zhengzhou’s economy was also hit by two Covid shutdowns and a severe flood that bankrupted small businesses and contributed to a rise in unemployment.

“[Local governments] Bert Hofman, head of the East Asia Institute at the National University of Singapore, said it was struggling with growing spending requirements, especially in the social sector, but the revenue base remained volatile. . “They’re really squeezed.”

On March 1, Zhengzhou began re-implementing measures to curb speculative buying – in line with Xi’s mantra that “home is for living, not speculation.” . Under the looser rules, the down payment rate for second homebuyers has dropped to 30% from 60%, and they can qualify for mortgages that cost 4.9%, compared with 6. % before.

City officials also reduced the time buyers have to wait before they could sell their homes from three years to one year, and provided subsidies for those with college degrees.

“We are doing everything, including allowing moderate speculation, to get the market working again,” said a Zhengzhou housing official.

Contrary to Mr. Xi’s push “Common Prosperity” and reduce China’s stark socio-economic divide, these measures boosted sales of high-end properties but did little to benefit middle-class buyers.

“There is no shortage of affluent buyers who understand the value of real estate investing,” said Lucy Wang, a sales agent at a high-end development in the northern suburbs of Zhengzhou. Wang sold 15 apartments, each priced at more than Rmb 8 million ($1.25 million), after the measures were announced.

Still, mass-market developers are still struggling to attract buyers across the country, even with discounts or discounts like free parking. Nationally, household savings rose 17% in the first three months of this year while their new debt, mainly mortgages, fell 46%.

Marketing staff at seven low- and mid-priced developments in Zhengzhou told the Financial Times they fell short of their monthly sales targets. The city is dotted with dozens of projects stalled by bankrupt developers.

An official at the Zhengzhou branch of China Merchants Property, a Shenzhen-based conglomerate, said: “People are scared to enter the market as they are surrounded by unfinished buildings run by owners. poor investment in construction.

One sure-fire second-guess buyer is Zhang Jian, an engineer in Zhengzhou, who last week pulled out of a Rmb1.2 million purchase of a property by Country Garden, the real estate conglomerate. China’s largest construction product. “I will wait for the market to weaken further,” he said.

Additional reporting by Andy Lin in Hong Kong